Table of Contents

- Budget 2024: Here Is How To Calculate Your Tax Relief

- IRS Releases New Inflation-Adjusted Tax Brackets for 2024 - YouTube

- A Guide to Tax Bracket & Tax Law Changes for 2024

- IRS announces 2024 income-tax brackets: Here’s what they mean for your ...

- Brenda Arriaga on LinkedIn: 2024 Tax Brackets

- NEW INCOME TAX BRACKETS FOR 2024 ANNOUNCED BY IRS - America’s best pics ...

- New Bracket Thresholds, Rising Contribution Limits, and Other Tax ...

- 2024 tax brackets: A look at the latest IRS tax bracket adjustments ...

- How Much will CPP Increase in 2024: Complete Analysis and Expectation ...

- General Election 2024 Comparison table of party tax policies | Evelyn ...

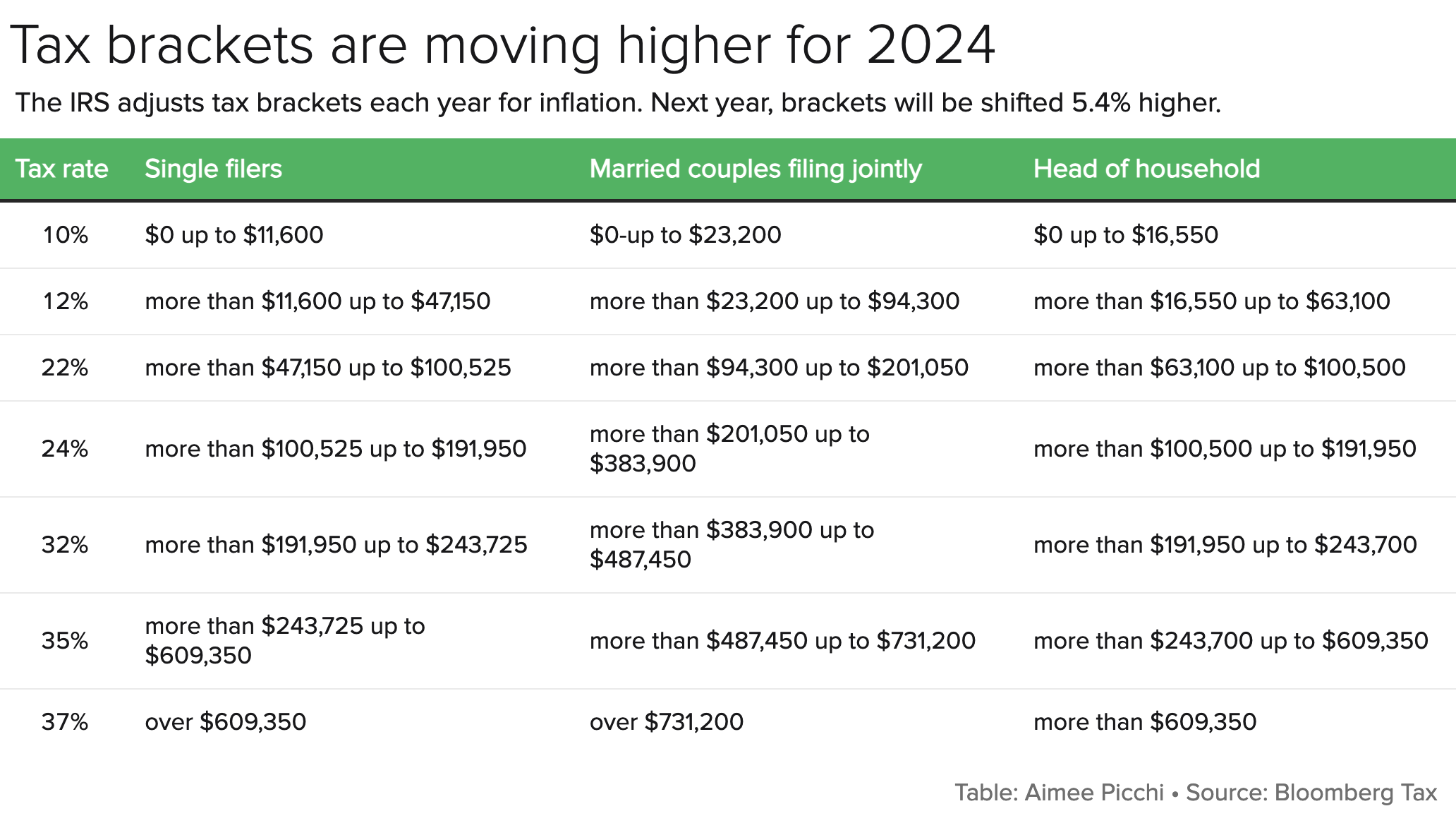

The Internal Revenue Service (IRS) has officially released the 2024 tax brackets, providing taxpayers with a clearer picture of what to expect when filing their taxes next year. The new tax brackets are designed to account for inflation, ensuring that taxpayers are not unfairly taxed due to rising costs of living. In this article, we will delve into the details of the 2024 IRS tax brackets and provide a step-by-step guide on how to determine which bracket applies to you.

What are Tax Brackets?

Tax brackets, also known as tax tables or income tax brackets, are the ranges of income that are subject to specific tax rates. The United States has a progressive tax system, meaning that as your income increases, the tax rate applied to your income also increases. The IRS adjusts the tax brackets annually to reflect changes in the cost of living, ensuring that taxpayers are not pushed into higher tax brackets due to inflation.

2024 IRS Tax Brackets

The 2024 tax brackets are as follows:

- 10%: $0 to $11,600 (single) or $0 to $23,200 (joint)

- 12%: $11,601 to $47,150 (single) or $23,201 to $94,300 (joint)

- 22%: $47,151 to $100,525 (single) or $94,301 to $201,050 (joint)

- 24%: $100,526 to $191,950 (single) or $201,051 to $383,900 (joint)

- 32%: $191,951 to $243,725 (single) or $383,901 to $487,450 (joint)

- 35%: $243,726 to $609,350 (single) or $487,451 to $731,200 (joint)

- 37%: $609,351 or more (single) or $731,201 or more (joint)

How to Determine Your Tax Bracket

Determining your tax bracket is relatively straightforward. Here's a step-by-step guide:

- Determine your filing status: Are you single, married filing jointly, married filing separately, head of household, or qualifying widow(er)?

- Calculate your taxable income: Add up all your income from various sources, including wages, salaries, tips, and investments. Then, subtract any deductions and exemptions you are eligible for.

- Compare your taxable income to the tax brackets: Look at the tax brackets table above and find the range that your taxable income falls into.

- Apply the tax rate: The tax rate corresponding to your tax bracket will be applied to the amount of income within that bracket.

Understanding the 2024 IRS tax brackets is essential for planning your taxes and making informed financial decisions. By following the steps outlined above, you can determine which tax bracket applies to you and estimate your tax liability. Remember to consult with a tax professional or financial advisor if you have any questions or concerns about your taxes. Stay ahead of the game and start planning for the upcoming tax season today!

Keyword density: IRS tax brackets (1.5%), 2024 tax brackets (1.2%), tax planning (0.8%), income tax brackets (0.5%)

Meta description: Learn about the 2024 IRS tax brackets and how to determine which bracket applies to you. Get a head start on tax planning and stay informed about the latest tax updates.

Header tags: H1 (1), H2 (4)